DAT is an incoterm published by the ICC, having its first edition in 1936 and the most recent one in January 2020. The recent edition has a new name for DAT, i.e., ‘Delivered at Place Unloaded’, but the responsibilities of the seller and the buyer remain unchanged.

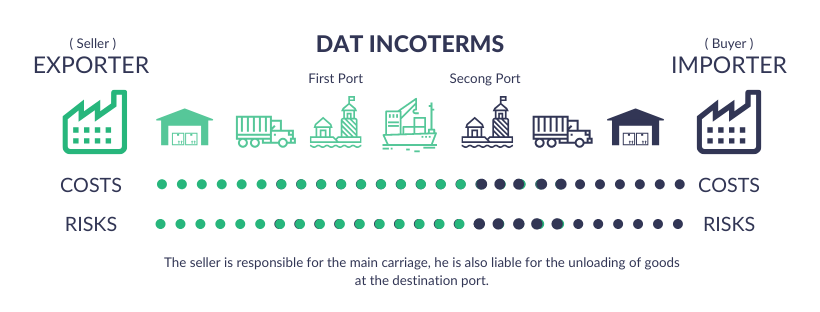

In Delivered At Terminal, the terminal is the nominated place of destination, which has a crucial implication in the shipping process. In DAT, the seller is responsible for the delivery of goods till the named port and the buyer liable for all charges thereafter.

Initially, the nominated port/spot at the location is acknowledged by both parties. At this port, the seller takes charge of unloading goods and the buyer looks after the import proceedings. Once the seller unloads the goods at the named port, the risk moves to the buyer.

DAT in shipping terms

- In DAT, the place of destination is agreed upon by both parties.

- The seller is responsible for delivery till the named place on port. (It can also be the terminal, transport hub, forwarding agent’s warehouse, etc.)

- The main carriage responsibility (from the first port to the second port) rests with the seller.

- The responsibility of unloading of goods at the destination port rests with the seller.

- Once the goods are unloaded the risk and costs are to be borne by the buyer.

Seller’s Responsibilities

Cost

Payment terms for the seller include:

- Warehouse charges: for maintaining goods till they are delivered

- Packaging charges: for marking and labeling goods as per export standards

- Inland transportation: for loading and transporting goods till the first port

- Deport charges: for port duties

- Freight forwarding charges: the freight forwarding agent’s fee for handling logistics

- Custom charges: for export customs proceedings

- Documentation charges: for preparing and submitting necessary documents required for the shipping process

Delivery terms

The seller has responsibilities till the nominated place of port, so he stays liable for the main freight proceedings. His duty stays till the delivery of goods at the first port, dealing with the documentation and shipping procedures. Further, the responsibility of unloading goods at the appointed port also rests with the seller.

Risk transfer

The risk of goods stays with the seller till the appointed place of port. He stays liable for any risk related to damage of goods till they are unloaded at the nominated port.

Insurance

Since the entire freight responsibility rests with the seller, he is liable for insurance coverage till the nominated place of port. He’ll bear all the insurance charges during the course; in the case of sea/ocean freight, he’ll have to take marine insurance for goods.

Duty and customs clearance

The seller has duties towards export customs proceedings. He stays responsible for preparing all necessary documents. Payment for port charges and customs clearing procedure, duties, and local charges are borne by him.

Buyer’s Responsibilities

Cost

Costs borne by the buyer include:

- Custom charges: for import customs proceedings

- Port charges: for port clearing procedures

- Inland transit charges: for transportation from the port to the warehouse

- Warehouse charges: for maintaining goods after the delivery of goods by the seller

Delivery terms

Under DAT terms, the buyer must accept the proof of documents provided by the seller at the destination port. He shall receive the goods delivered at the port.

Risk transfer

The risk of goods transfers to the buyer after the delivery. Also, if the buyer fails to instruct the seller in reference to the nominated port, the risk and damage will be borne by him.

Insurance

As the carriage duty rests with the seller, insurance is his responsibility. The buyer has no obligation to insurance.

Duty and customs clearance

As the duties transfer at the nominated harbor, the buyer is responsible for import customs and duties. He remains liable for all payment charges and risks thereafter. Acquiring all necessary documents provided by the seller at the appointed port and carrying out further import proceedings are a part of his responsibilities.

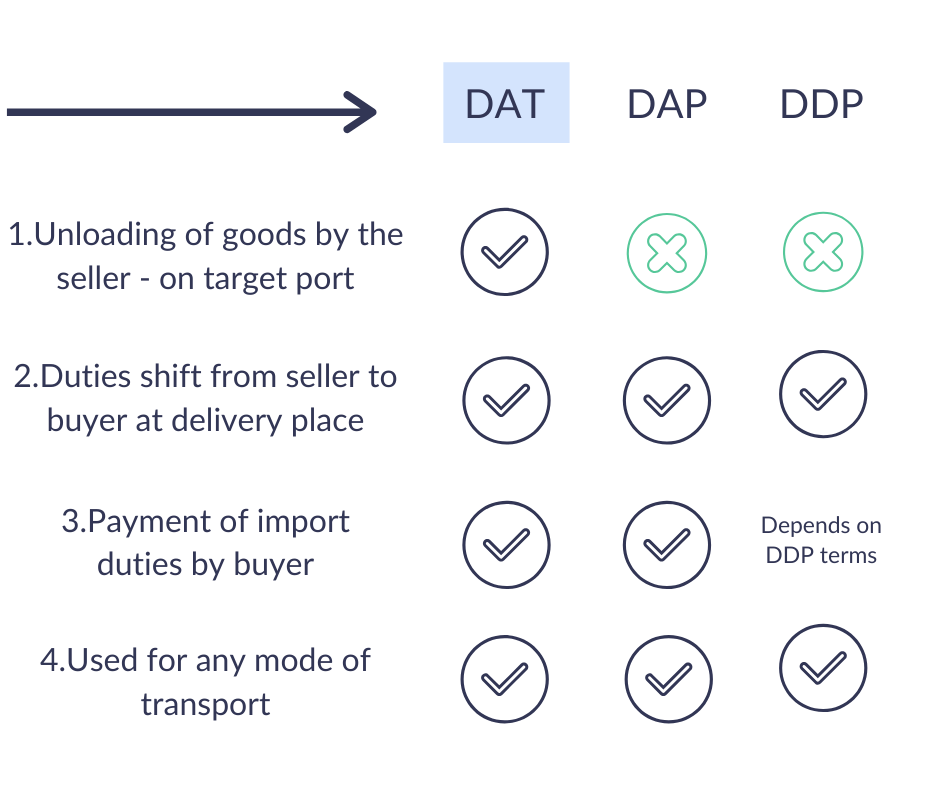

Difference Between DAP, DAT & DDP

FAQs on DAT Incoterms

Does DAT include duty?

Yes, DAT does include customs duty, but both the parties have to contribute towards it. The seller has to take care of export duty and the buyer has to take care of import.

Does DAT include unloading?

The seller has to take care of unloading of goods at the destiation port as per DAT.